By Mel Dorman, July 9, 2020

A brief time back, I noticed that a report by Redfin discovered list prices had just plunged by 6.4% from March to April. This was the same number of thought, the main indication of a general decrease in housing costs. So far, that’s not what has happened.

Why Housing Prices Are Rising

For one, Redfin information was misleading because they were pointing to the listing price of properties on market, not the true price of properties that really sold.

Moreover, the entirety of the information came out right as the pandemic was beginning to hit the United States. Properties are usually under contract for 30 days before closing. Secondly, the business information from March originated from properties with contracts marked in February, when COVID-19’s effect on the U.S. was insignificant and many questioned if it would turn into a significant issue.

But more importantly, there are two major reasons that real estate prices continue to rise:

Reduced Supply

Even that Redfin study from late March found a massive decrease in week-over-week new listings across virtually the entire country. This ranged from -17% in Tampa Bay, Florida, to an astounding -63% in Philadelphia. In Portland, we have seen around 25%-40% less listings, week to week, when we look back 1 year. Multiple offer situations are the norm and it feels like the strong sellers market of 2016 all over again.

Only Phoenix had more listings, at 5%.

The Wall Street Journal quotes Zillow’s senior principal economist Skylar Olsen, noting that, “Demand absolutely just got a kick in the gut, but at the same exact time, so did supply.”

Indeed, so did supply.

For example, as the same article points out, mortgage applications for home purchases were down “20% from a year earlier,” according to the Mortgage Bankers Association, and total listings of homes for sale “hit a five-year low,” according to Redfin.

Federal Action

Whatever you think about the government’s reaction in 2008, they were at any rate conservative by today’s standards. Not all that this time around. The administration has emptied cash into the business sectors in an unprecedented way.

The Federal Reserve has brought down its benchmark financing cost to 0%, and it is probably going to remain there for a long while (that is on the off chance that they don’t figure out how to drive it into the negative). The legislature has pushed through a $6 trillion improvement bargain ($2 trillion in direct cash to families, organizations, and partnerships and $4 trillion worth of purchasing securities through the Federal Reserve). Also, more is probably going to come.

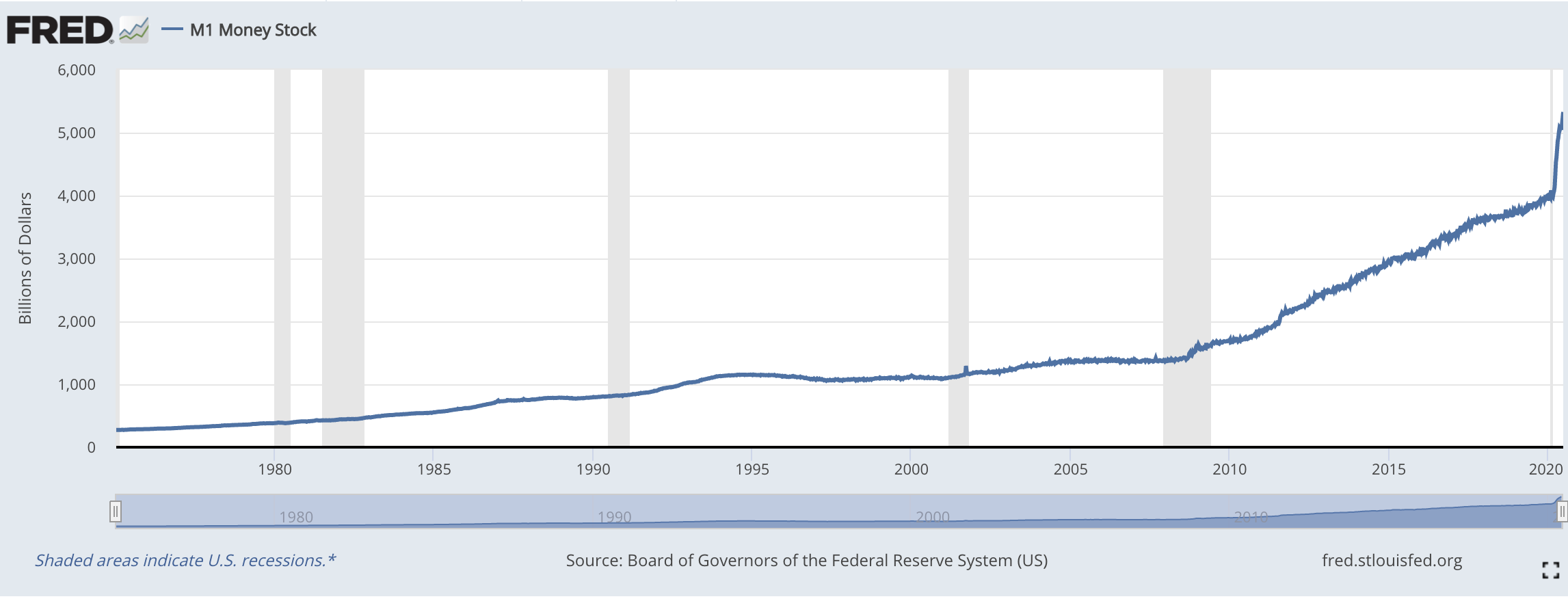

All of this cash, obviously, isn’t lounging around in the Treasury. It is either borrowed or, as it’s been said, printed. If all things are equal, more money means inflation is coming around the corner. Below is a snapshot of the infiltration of cash into our economy. You can see 2008 had a fraction of what we are seeing today.

Growth in M1 Money Supply: Federal Reserve Bank of St. Louis

If you are sitting on the sidelines waiting for real estate to drop in price so you can “jump on a deal”, I wouldn’t hold your breath. With high inflation around the corner, your dollars will lose value and it will cost more to buy real estate. Better to buy real estate during record low interest rates today and watch your property rise with the tide of inflation. Not to mention, eventually such an inflationary spiral will probably require the Federal Reserve to substantially raise interest rates like was done in 1982 in order to “break the back” of the high inflation that had been haunting the United States throughout the ’70s. If you wait, you will not only spend more to buy real estate but you could also have a much worse interest rate.