By Mel Dorman, March 11, 2021

In the last month, active home shoppers have experienced the first jump in interest rates that we have seen since May 2020, when rates were very unstable at the beginning of the pandemic. Since that time, the federal reserve has kept interest rates artificially low to prop up the economy.

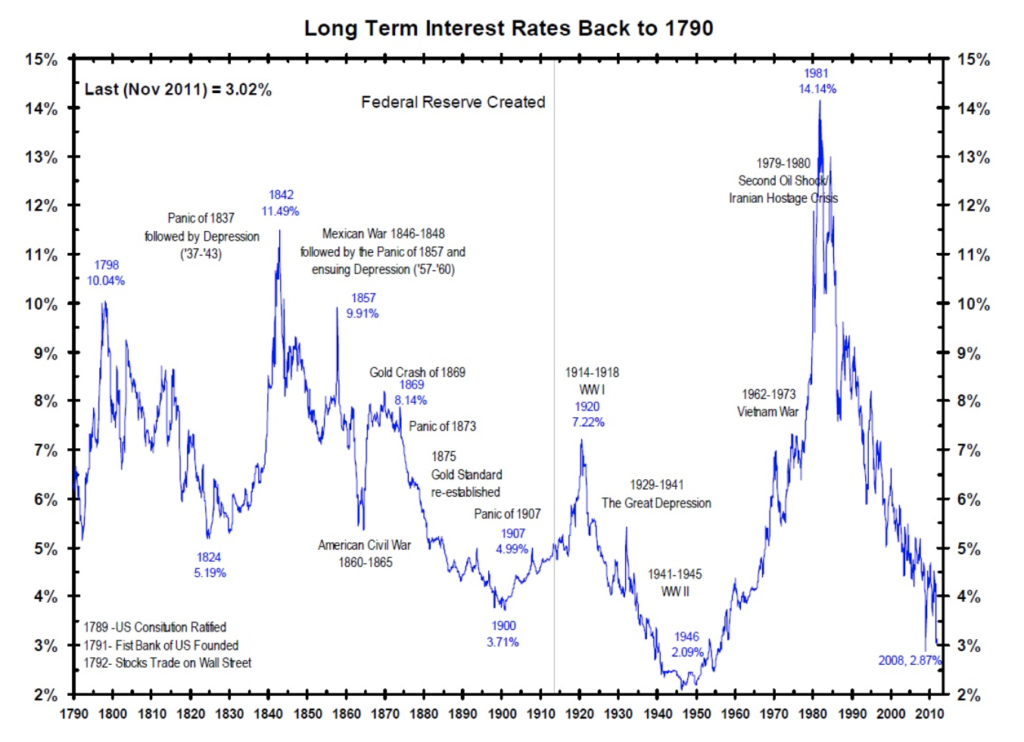

As a result, this past year we have experienced record low interest rates, not seen since 1946!

However, those who just began shopping have a false sense of “loss” when the rate jumped .5% in a matter of a few weeks. I have heard client’s say “Interest rates are rising?… Should I stop shopping?”

My answer: Absolutely not. Lemme explain why…

These rates are still good!

It’s been said that “the enemy of good is perfect”. Yes, if you bought in January 2021, you likely timed the interest rate market perfectly and there will be no lower rate for years to come or maybe ever. Congrats. However, historically speaking rates are still extremely low. Don’t miss the bigger picture. Take a look at the chart below and see anything below 5% is a great rate!

Why should you definitely still buy?

The reason interest rates are going up is because inflation is taking place. Rewind to the beginning of the pandemic; the government asked people to stay home, many businesses failed, people lost their jobs, so the federal government also took on the responsibility of pumping money into the economy through stimulus plans to keep our economy afloat. It worked….But this money didn’t just come from reserves we had built up. No, the government also created new money by printing it. And a year into this, we are finally starting to see the impact of our old dollars lose value as new dollars fully entered the economy; this is called inflation. For example, a product purchased for $1 in 1913 would cost $ 26.25 in October 2020. Inflation isn’t new, but it might very well be accelerated by the amount of new money printed last year. How much new money, you may ask? About 1 in every 5 dollars is a new dollar. Let that sink in.

How do you guard against inflation?

You own assets, like real property! You see as the dollar loses value it will cost more dollars to buy a house. If you are one of the lucky people who already owned a home, then you are rising with the tide of inflation. If you do not, then you miss out. Worse yet, your rent will increase with inflation as well. Historically Portland has seen a 5-7% increase in rents year over year. As inflation increases, this percentage will likely rise as well.

The take away: Be prudent and buy a home with a 30 year fixed rate mortgage. Then sit back and rise with the tide of inflation as you watch your home value climb while all the other expenses rise with it. Rest assured that at least your monthly mortgage will remain the same, despite inflation all around us.