VOLUME 21

Hey Buyers + Sellers

We Are Your Real Estate Strategists!

While we love the “mini season” of fall as a fantastic time to buy or sell, it’s also the perfect time to look ahead and strategize for the coming year. Yes, we market your listing, orchestrate your home search, and negotiate fiercely to get you the very best outcome. Our ultimate role though, is bigger than that: we are your real estate strategists. You have questions, we bring solutions.

Is now the right time to buy or sell?

How should you prepare for a purchase or listing?

Is an investment or vacation property a smart move this year?

How do you prioritize your home search when there are so many options?

We help you understand the market on both the micro level (your neighborhood, your block) and the macro level (rates, inventory, timing). We can connect you with trusted lenders, clarify interest rates and property taxes, and help you get ready emotionally, financially, and logistically for your next move. We guide you step by step: prepping your home and yard, choosing which repairs are worth it, and making sure every dollar you invest counts.

Whether buying or selling, think of us as your first stop for real estate strategy. Let’s map out the path that gets you where you want to go, and let’s do it now so that you can make the most of the market!

-

- Buyers who get pre-approved early are 44% more likely to close successfully (National Association of Realtors).

- Homes that are staged and prepped before listing sell for 6–10% more and they sell faster (Real Estate Staging Association).

- Buyers who plan ahead and enter the market in the late fall/early winter save 2–5% on purchase price compared to spring buyers! (ATTOM Data).

- Strategizing early lets sellers tackle only the high-ROI projects (like paint, yard tidy and repairs) skipping expensive remodeling that rarely pays back at closing.

VOLUME 20

Hey Buyers

When’s The Right Time To Buy?

Right Now.

Thinking about making a move but waiting for mortgage rates to drop, inventory to grow, or the “perfect” home to appear?

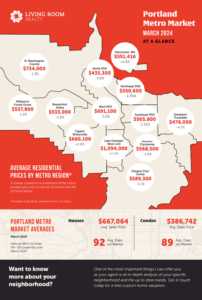

Here’s the truth: if you want to win in this market, you need a winning strategy. Right now, inventory is up 12% over last year, giving buyers more choice. On a single day, you could see five or six solid options that meet your goals hit the market. Prices are also working in your favor — the 7-day average list price in the Portland Metro was around $700,000 back in June, and today’s median sits just under $660,000. New listings are averaging around $629,000.

That’s REAL opportunity.

Meanwhile, mortgage rates are holding steady. Waiting for them to drop might feel tempting, but remember: every 1% drop invites about five million more buyers nationwide into the market. That means more competition, fewer choices, and higher prices. Don’t forget, history shows us prices tend to rise again in the spring.

This fantastic fall mini season will be here for just another 6–8 weeks. Don’t miss your chance to lock in a great deal and settle into your new home before the holidays.

VOLUME 19

Hey Buyers + Sellers – Welcome to the Mini Season!

Fall is one of our favorite times of year for real estate – a little sweet spot we call the “mini season.” Inventory is still healthy, interest rates are attractive, and serious buyers and sellers are stepping forward to make things happen before year’s end. Our team has a strong track record of getting homes sold quickly and helping buyers land great deals in this season. If you’re wondering whether you’ve missed your chance – you haven’t! There’s still time to buy or sell and be settled in your new home in time for the holidays.

Mini Season Market Snapshot

Buyers still have options, and sellers still have leverage. The window is open – let’s make your move before the holidays!

VOLUME 18

WHY CONDOS?

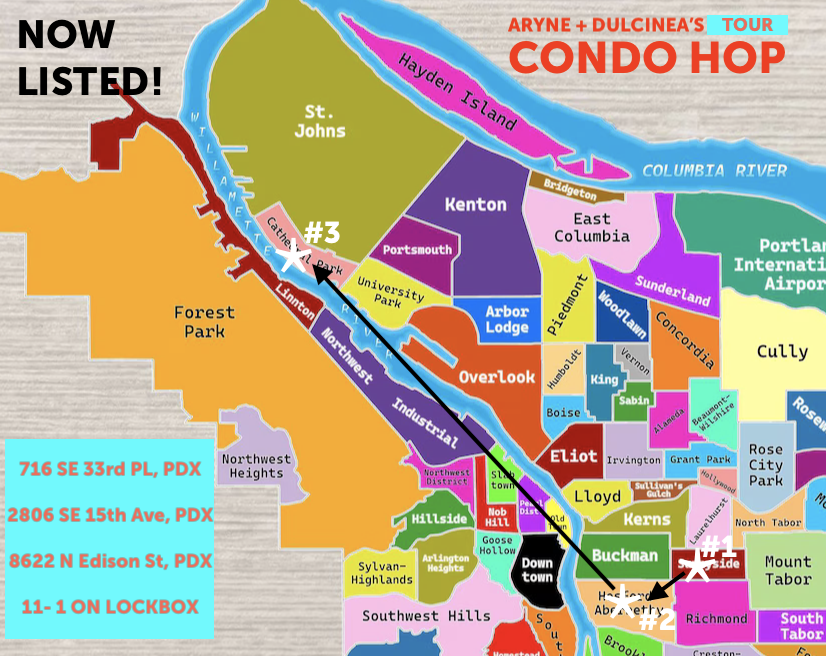

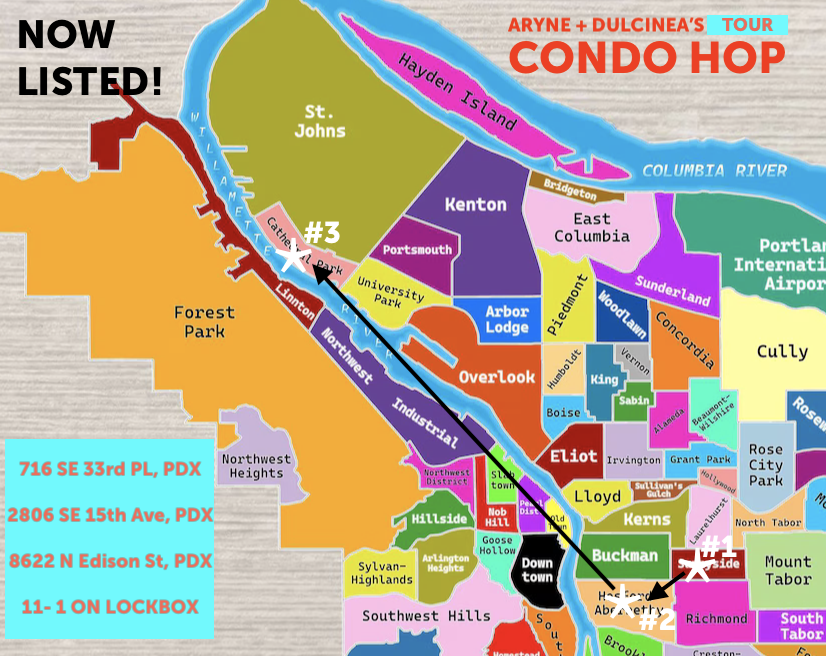

We have 3, count them, 3 amazing condo options on the market right now

So, why do buyers like condos over houses? It’s simple…that’s right, simple! Condos offer a simplicity of living that owning a home can’t. Typically, the HOA dues cover some or most utilities and exterior maintenance, making life a bit simpler for the owner. If the HOA is well-run, living in a condo can make life easier, and…you get to own the building with other people, creating an instant community. If you would like to TOUR OUR LISTINGS, please reach out to us today, and we will set up a private viewing.

* CONDOS NOW LISTED *

IT JUST DOESN’T GET BETTER THAN THIS!

CONDOS OFFER A LIFESTYLE AND A PEACE OF MIND FOR MANY BUYERS. ALL THREE OF THESE CONDOS OFFER BEAUTIFUL SPACES, AMAZING LOCATIONS, SUPERIOR AMENITIES, AND MUCH MORE! WHETHER FRESHLY UPDATED OR JUST 5 YEARS YOUNG, EACH OF THESE CONDO OPTIONS IS A SOLID BET!

VOLUME 17

HEY BUYERS

THIS ONE IS FOR YOU

RATES! RATES! RATES!

Have you heard the news? The Federal Reserve meets next week, and everyone is predicting they will drop rates! Did it just get less costly to buy a house?! Exactly what does a “rate drop” mean for real estate?

Here’s the skinny:

WHAT IS THE FEDERAL RESERVE: The Federal Reserve (aka “The Fed”) is the USA’s central bank. Its governors set interest rates to keep inflation low and the overall economy humming. Their decisions don’t determine your interest rate but they can influence it.

HOW DOES THE FED WORK? At some of their regular meetings, the governors specifically set the federal funds rate (not mortgage rates) which can impact borrowing costs across the entire economy—think car loans, student loans, credit cards, and home loans. When the Fed raises rates to fight inflation, mortgage rates often climb. When they cut rates to stimulate the economy, mortgage rates can ease.

HOW DOES THE FEDERAL FUNDS RATE AFFECT MY MORTGAGE? Mortgage rates are actually more affected by a different rate called the 10-Year Treasury Yield. What is that? It’s the interest rate the government pays when it borrows money for 10 years. When the yield goes up, mortgage rates usually rise too (and vice versa). Sometimes the mortgage rate changes in anticipation of a rate adjustment.

WHY DOES THIS MATTER? Even a small change makes a big difference! For example, on a $400,000 loan, a mortgage rate drop from 6.5% to 6.25% saves about $65 per month—nearly $800 a year.

YOUR MOVE: The Fed’s decisions ripple into mortgage rates. Even small shifts can save you BIG. Want to BUY NOW? Let’s connect now so you’re ready to lock in the best possible rate and monthly payment when the timing is right.

VOLUME 16

HEY SELLERS

THIS ONE IS FOR YOU…and Your Ultimate Success!

Thinking about selling in 2026, but the spring market feels like a lifetime away? Our advice: let’s start preparing now. If you’re even considering selling next year, invite us over today to start the conversation. Getting a home ready for market can take time, energy, and sometimes a bit of investment. While you don’t need to do any heavy lifting right this minute, the end of summer is the perfect time to start planning.

Here’s what we’ll cover in a listing consultation:

Tour of your home and yard.

Recommendations for repairs or upgrades before listing.

Introduction to trusted professionals who can help get things done.

A step-by-step overview of our proven listing process including pricing, marketing, negotiation and closing.

Why timing matters:

Portland’s inventory is up from last year—buyers have more choices. Sellers who prep early can make their listings stand out.

While people buy homes all year round, spring listings sell faster than homes listed later on.

Properties that are priced right and prepped well bring in more offers, which can drive up your final sale price.

Our goals are to keep things low-stress, guide you through your transaction, and help you achieve the best outcome for your sale. Starting early means:

Timing your listing to align with the height of the market.

Avoiding the crunch of last-minute prep.

Positioning your listing for faster offers and stronger returns.

Let’s get the conversation started!

VOLUME 15

HEY BUYERS

What the Heck is a Home Inspection?

You’re pre-approved, you’ve toured some homes, and you’re this close to writing an offer. But then, what about the inspection? Who does it? What if they find something wrong?!

Take a breath—we’ve got you.

A home inspection is a top-to-bottom checkup by a certified inspector. We also recommend three key environmental tests: a sewer scope, a radon test, and a search for underground storage tanks. Together, these cover the home’s major systems—roof, plumbing, electrical, heating and cooling, windows, doors, and more. Inspectors crawl into attics and crawlspaces, scope the sewer line, test for radon, and check for old oil tanks. Every concern is documented in detailed reports with photos and recommendations, giving you a clear picture of the home’s condition.

Here’s the best part: you’re not alone. We attend the inspection with you, bring in trusted contractors if needed, and help you understand what’s minor, what’s major, and what it might cost. From there, you decide: negotiate repairs or credits, tackle projects yourself, or, if it’s too much, walk away and move on.

Buying a home can feel overwhelming, but with us in your corner, inspections become just another step on the way to getting the keys.

VOLUME 14

Hey Buyers, We Get It

Owning a home is about so much more than paying for a place to live. Yes, it’s the cost of shelter—but it’s also a big life transition, a lifestyle reset, and a chance to shape your future. It can feel exciting, daunting, even overwhelming. This is where you’ll cook family dinners, create art, relax after a long day, work from home, grow your garden, and build community.

We don’t just help you buy a house—we bring the expertise, strategy, and market insight that set you up for success. With years of experience navigating Portland’s unique market cycles, we know how to identify value others might overlook, craft offers that stand out in competitive situations, and guide you through negotiations to protect your interests and your budget. Our deep network of lenders, inspectors, contractors, and service pros means you have the best resources at your fingertips—not just during your purchase, but for years after.

The fall market, our “sweet spot” mini season, is almost here. As summer winds down, motivated sellers list before the holidays, creating fresh opportunities with less competition than spring. If you’ve been thinking about buying, now’s the time to prepare—and you’ve got us in your corner.

For us, it’s never just about buying a house. It’s about using skill, experience, and relationships to help you create a home and a life you love.

VOLUME 13

LETS GO BUYERS!

Why You Should Get Pre-Approved Now, Even If You’re Not Ready to Buy Yet

Thinking about buying a home, this year, next year, or even further down the road? Here’s your gentle nudge: it’s never too early to talk to a mortgage broker and get pre-approved. Pre-approval means knowing how much you can borrow and having documentation ready that shows sellers you’re serious. It’s not just a formality, it’s a key step toward success. We work closely with top-tier mortgage pros (like Aaron Nawrocki at Capital M Lending, who supplies the weekly rate info you see here), who are excellent at walking buyers through the process.

Even if you’re months or years away from making a move, the truth is that if your dream home hits the market tomorrow, you won’t be able to act without a pre-approval letter in hand. More than that, pre-approval paints a realistic picture of your purchasing power. You might qualify for more, or less, than you expected, and that knowledge will help shape your timeline, budget, and expectations. You’ll also get details on what you’ll need in addition to your loan: down payment, closing costs, and moving expenses.

Best of all? It gives you time. Time to improve your credit, adjust your budget, or plan ahead strategically and with intention.

Don’t wait for the “perfect home” to start getting ready.

Want help getting started? We’ve got you.

VOLUME 12

LETS GO BUYERS!

Why You Should Get Pre-Approved Now, Even If You’re Not Ready to Buy Yet

Thinking about buying a home, this year, next year, or even further down the road? Here’s your gentle nudge: it’s never too early to talk to a mortgage broker and get pre-approved. Pre-approval means knowing how much you can borrow and having documentation ready that shows sellers you’re serious. It’s not just a formality, it’s a key step toward success. We work closely with top-tier mortgage pros (like Aaron Nawrocki at Capital M Lending, who supplies the weekly rate info you see here), who are excellent at walking buyers through the process.

Even if you’re months or years away from making a move, the truth is that if your dream home hits the market tomorrow, you won’t be able to act without a pre-approval letter in hand. More than that, pre-approval paints a realistic picture of your purchasing power. You might qualify for more, or less, than you expected, and that knowledge will help shape your timeline, budget, and expectations. You’ll also get details on what you’ll need in addition to your loan: down payment, closing costs, and moving expenses.

Best of all? It gives you time. Time to improve your credit, adjust your budget, or plan ahead strategically and with intention.

Don’t wait for the “perfect home” to start getting ready.

Want help getting started? We’ve got you.

VOLUME 11

HEY BUYERS – Want to make your bestie your neighbor?

Most of our clients come to us through referrals from friends, family, neighbors, and happy past buyers, and we take that as the highest compliment. Why? Because our mission is to serve you so well that you feel excited to share us with the people you care about most.

When you’ve found your dream home and fallen in love with your new block, what could be better than bringing a friend or loved one into the neighborhood too? Whether it’s your best friend, sibling, coworker, or favorite cousin, we’d be honored to help them find a place they love, right near you.

We treat every referral like family, and we’ll go above and beyond to give them the same thoughtful, expert guidance you received. So go ahead – share the love, and let’s build your dream neighborhood together, one friend at a time.

VOLUME 10

HEY BUYERS – Why This Might Just Be Your Moment to Buy a Home

Right Now, the market is holding steady, which means opportunity for buyers like you.

Sale prices have leveled out, inventory is up, and many sellers are finally listing because they need to move. Translation? More homes to tour, more room to negotiate, and less of that frenzied bidding war energy we saw over the past few years. Sure, some listings still attract multiple offers, but many others are waiting patiently for the right buyer to walk through the door. That buyer could be you!

In fact, you’ve got more choices now than at any point in the last five years. Guess what, if you buy before rates drop, you’ll be in a position to snag a great home now and refinance into a better rate later. That’s a strategic win.

Your mission, should you choose to accept it, is to look at listings with a sharp eye for value, livability, and long-term potential. Our mission? To help you do exactly that. At the Dream Digs Team, we’re more than agents, we’re your real estate strategy gurus, expert negotiators, and relentless home-finding bird dogs.

Let’s take advantage of this moment and go find the one that fits your life and your future.

VOLUME 9

Your Dreamy Next Chapter Here’s How to Sell One Home and Buy the Next

Ready to downsize into your dream retirement pad, but not sure how to juggle two transactions at once?

If you need to sell your current home in order to finance your next one, it can feel overwhelming. But don’t worry, the Dream Digs Team has you covered.

We’ll start by helping you understand what your current home is worth and what your purchasing power looks like. If you’ve built equity (and chances are, you have!), that equity can help you make a strong, competitive offer on your next home, without stretching your finances.

Then it’s time to dream big:

A chic condo in the Pearl?

A sweet Mt. Tabor bungalow with city views?

A garden retreat surrounded by trees?

Or maybe a sleek townhouse just off NW 23rd?

While you explore what’s next, we’ll guide you through prepping your current home for sale, and make sure the timing works in your favor. With our experienced team, proven systems, and seamless communication, we’ll handle the logistics so you can stay focused on the future.

Let’s make this next chapter your best one yet.

VOLUME 8

We get it—rates are up, the headlines are dramatic, and summer’s here…and you’d rather be out playing.

But here’s what we’re seeing on the ground: inventory is up. While some listings still spark bidding wars, plenty of others don’t. That means serious buyers can land great homes with less competition—and with more negotiating power.

Sellers are more open to making deals after inspections, whether that’s closing cost credits, repairs, or even price reductions. We’re seeing buyer wins that just weren’t on the table a couple of years ago.

And here’s the other BIG thing: home values usually go up over time. The house you’re eyeing today? It’s probably going to cost more in a few years—and that’s time you could’ve spent building equity, customizing your space, and settling into your next chapter.

Buying now isn’t about timing things perfectly (no one can). It’s about getting in, starting your investment, and letting time work in your favor.

The market won’t wait, but we will. When you’re ready to get clear, get smart, and get moving, the Dream Digs Team is here—no pressure, just real support.

VOLUME 7

Expert Negotiators: Your Secret Weapon for Saving Thousands

Finding the right home is just the beginning; saving you serious money is where we really shine.

As your buyer’s agents, one of the first moves we make is asking the seller to cover our fee. That one step alone can save you $10,000 to $30,000, that’s money you can keep for moving costs, upgrades, or that first big Home Depot run.

We don’t stop there, though. Once you’re under contract, we go into full-on negotiation mode. During inspections, we’ll advocate for closing cost credits, necessary repairs, or even a price reduction, whatever helps you reach your financial goals and feel great about your purchase.

At the Dream Digs Team, we believe you should feel smart, supported, and empowered every step of the way. We’ve got your back, from first showing to final signature.

We’re ready to help make your next move a powerful one.

VOLUME 6

Top 3 Questions Buyers Are Afraid to Ask (But Totally Should)

Buying a home is a big deal, and no one expects you to know everything out of the gate. If you’re a first-time buyer (or it’s been a while), you might be wondering what you should know… and feeling a little awkward about asking.

Let’s take the pressure off. Here are three questions buyers ask us all the time (and yes, you should ask too):

1. What is an offer, exactly?

An offer is your official proposal to buy a home. It includes more than just the price – things like your closing date, financing, earnest money, and contingencies all get spelled out in a multi-page contract.

We’ll send you a blank version to review before you even start house-hunting, so nothing catches you off guard. When it’s time to write, we’ll walk you through every step so you know exactly what you’re signing.

2. What happens during a home inspection?

Think of this as your house health check. A licensed inspector looks at the major systems – roof, plumbing, electrical, foundation, and more. We also recommend a few key environmental inspections (we’ll cover those at your first tour).

Afterward, we’ll help you decide if it makes sense to ask for repairs, credits, or a price adjustment.

3. What’s an appraisal?

If you’re using a loan, the lender needs to confirm the home is worth what you’re offering. A neutral third-party appraiser visits the property, crunches the numbers, and sends a report. Once the home appraises, you’re one big step closer to the finish line.

At the Dream Digs Team, no question is too small or too obvious. We’ll keep you informed, prepared, and totally supported – from your first showing to the closing table.

Let’s find your next home – together.

VOLUME 5

BUYERS – Four walls and a fair price?

That’s the bare minimum.

Whether you’re buying your very first home or searching for your version of the Barbie Dreamhouse, figuring out your real priorities can be harder than it sounds. The truth is, having a clear sense of what matters most will save you from getting side-tracked by shiny listings that, while exciting, don’t actually fit your life. That old real estate adage? Location, location, location. It still holds up. You can change a home’s finishes or condition, but you can’t change where it is. So if walkability, neighborhood vibes, or school zones top your list, it pays to stay laser-focused on location.

On the flip side, if space, layout, or a certain number of bathrooms is non-negotiable, you may need to explore new areas to get what you want. Sometimes, it’s the little things that make a house feel like home to you: a fireplace, a wraparound porch, or that perfect view of the river. Without a clear sense of priorities, it’s tough to decide what to see, and even tougher to know when it’s time to make an offer.

That’s where the Dream Digs Team comes in.

At our very first buyer consult, we’ll help you sort through it all: your must-haves, your nice-to-haves, your cherries on top, and your absolute dealbreakers. Then we’ll send you a personalized spreadsheet with everything laid out in the order of priority we heard from you. You’ll get a chance to review and revise, so before you even step inside a house, you’ll know precisely what you’re looking for, and exactly what you’re not.

Whatever your priorities, the Dream Digs Team is here to help you find a home that fits just right.

VOLUME 4

BUYERS – IS THIS GOOD NEWS?

What’s Happening in Portland Real Estate (and Why It’s Good News for Buyers)

Spring is in full swing, and the Portland market is starting to show signs of change – in a good way! Aryne just put together a quick video with all the details but here’s the high-level scoop:

Active listings are up nearly 28% from this time last year

New listings have increased by 8%

Pending sales are down just slightly, about 2.5% year over year

Homes are spending an average of 85 days on market (but the median is just 35, so the good ones are still going fast)

Average sale price is down 4.5% from last year, but up 3.6% from last month

Thinking about making a move?

At the Dream Digs Team, we’ve got you. We’ll set you up with a smart search strategy, connect you with a great lender, help you tour homes with a sharp eye, and guide you through offer writing, inspection, and closing with zero pressure. This could be your season. Let’s talk.

VOLUME 3

Open Houses vs. Private Tours:

What’s the Move?

Even if you’ve got an agent, open houses are still worth your time. They’re a no-pressure way to explore different styles, layouts, neighborhoods, and finishes, and sometimes help you figure out what you definitely don’t want. You might even stumble on something wonderfully unexpected. Plus, open houses can spark new questions or ideas to bring back to us. With more listings on the market this spring, open houses are a great way to peek around.

Once you are really clear on what you want, though, private tours are where the magic happens. No crowds, no rush – just time to really feel out the space, ask the smart questions, and get insight from us. These one-on-one tours help you cut through the noise and focus on the homes that truly fit.

You’ve got this – and we’ve got you!

VOLUME 2

Hey Buyers!

Yep, there’s competition. But you’re ready!

Let’s be real: the market can be competitive. Some homes, especially the ones you love the most, are moving fast. In these cases, multiple offers are common, and it can feel a little intense. But don’t let that scare you off. Competition doesn’t mean something shady is going on – it just means a lot of people are out there looking for the same great things you are.

Here’s a little insider secret: it’s not always the highest price that wins. Sellers care about more than just dollars – timing, clean terms, and confidence in the buyer can go a long way. That’s where strategy (and a little guidance) makes all the difference.

So take a deep breath. With the right plan and someone in your corner, you can show up strong, make smart moves, and get the home that’s right for you.

You’ve got this – and we’ve got you.

VOLUME 1

A Tale of Two Markets… and why it matters to buyers

We’re in a market that’s telling two very different stories at the same time.

Story #1: You see a house, it’s gorgeous, and you love it. Guess what? So does everyone else. In these cases, the list price is basically a suggestion – your job as a buyer is to rise to the occasion. That means coming in strong, clean, and fast if you want to win.

Story #2: You see a house that’s been sitting for weeks. That doesn’t always mean something’s wrong with it. Often, it just means it was priced too high out of the gate, and now it’s overlooked. These homes can offer amazing opportunities if you know how to spot them and negotiate well.

Same market. Two totally different strategies.

Knowing which one you’re in is where we come in – we help buyers read the room, make the right moves, and come out with the win.

Continue reading “REAL ESTATE NEWS: BUYER SERIES”

Looking to buy your first property in Portland Oregon? You’re in luck! This blog post will outline some great neighborhoods to invest in, as well as give you an idea of what type of lifestyle you can expect. Keep reading for more information!

Looking to buy your first property in Portland Oregon? You’re in luck! This blog post will outline some great neighborhoods to invest in, as well as give you an idea of what type of lifestyle you can expect. Keep reading for more information!

When Haley & Erik set out to buy their first home, they never imagined they would get so lucky. They happened upon an open house in Milwaukie & decided to check it out. Immediately the colorful interior, spacious yard with the 200 year old oak tree and layout of the home felt right to them. With their ducks in a row, we were set to write an offer.

When Haley & Erik set out to buy their first home, they never imagined they would get so lucky. They happened upon an open house in Milwaukie & decided to check it out. Immediately the colorful interior, spacious yard with the 200 year old oak tree and layout of the home felt right to them. With their ducks in a row, we were set to write an offer.