Early fall market staying active

We’re about to begin Q4 of the 2021 housing market on Friday, and so I wanted to check-in to provide some brief commentary on what I’ve been seeing, what’s been working for my clients, and what I expect to happen in the coming months.

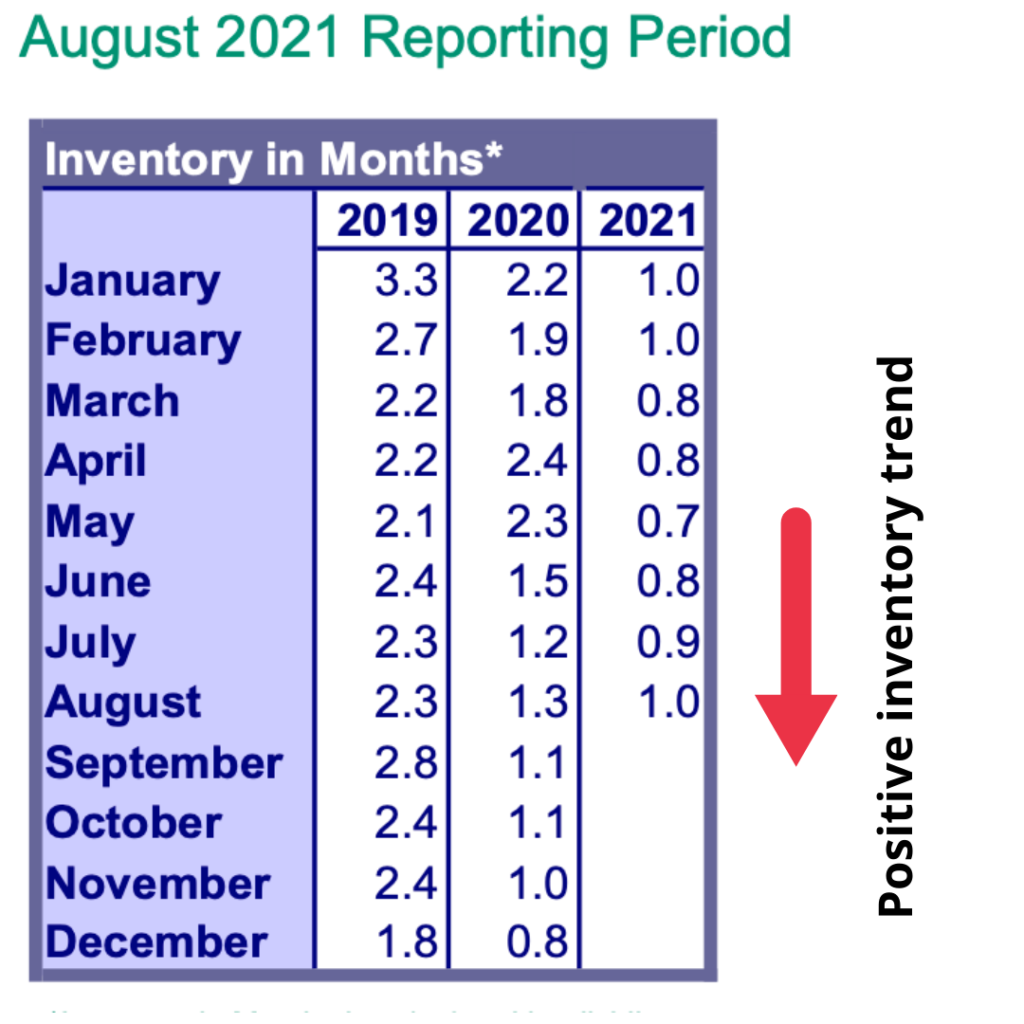

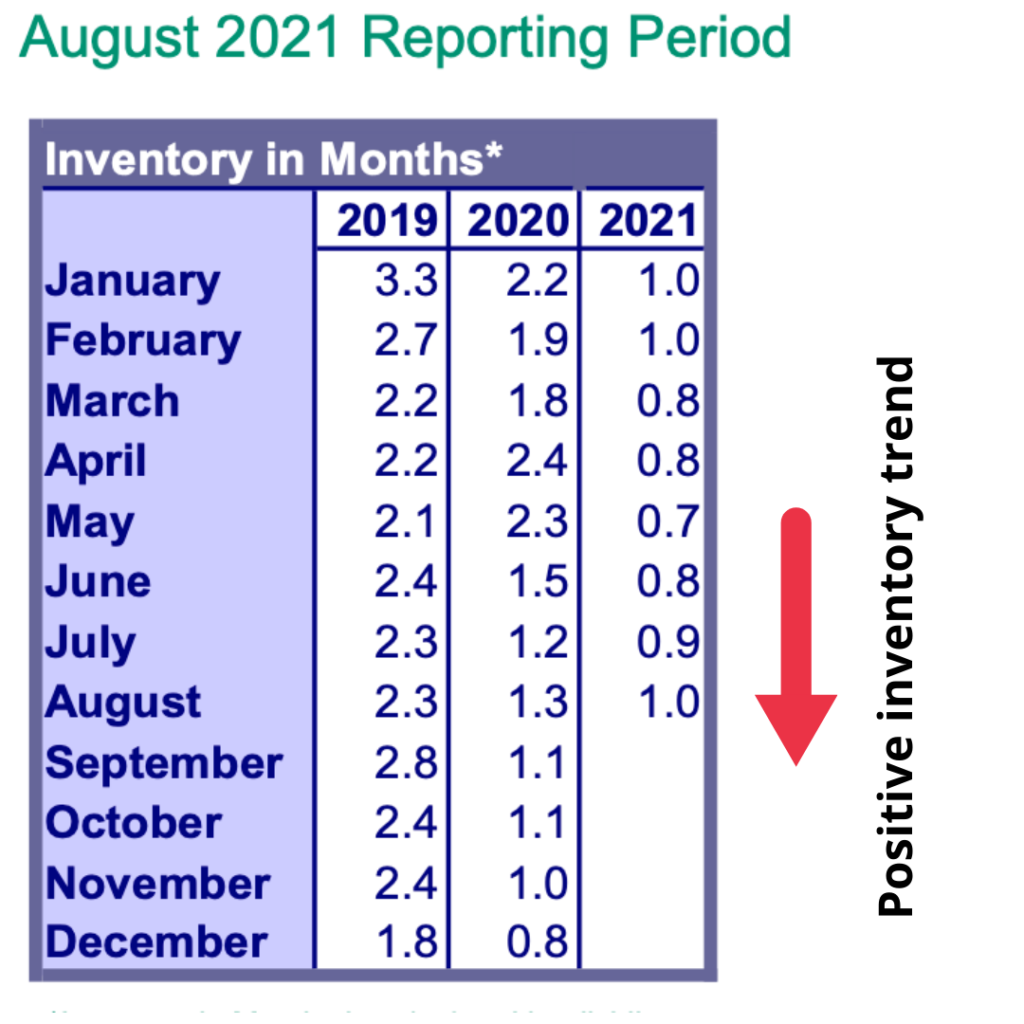

We came into this fall season with some unknowns in terms of the availability of new listings, mortgage rates, and where trends on pricing were headed. While we did see a slight, continued uptick in available inventory in August (see image below), we’ve had a solid September with a steady stream of new listings each week. We’re seeing many more occupied homes now than at any time since the start of COVID. With vaccinations fairly widespread in the Portland metro area, sellers seem to be more comfortable with having prospective buyers come through their house. I also think we’re seeing extra listings now as people may have put off listing their home with so many unknowns over the past 18 months.

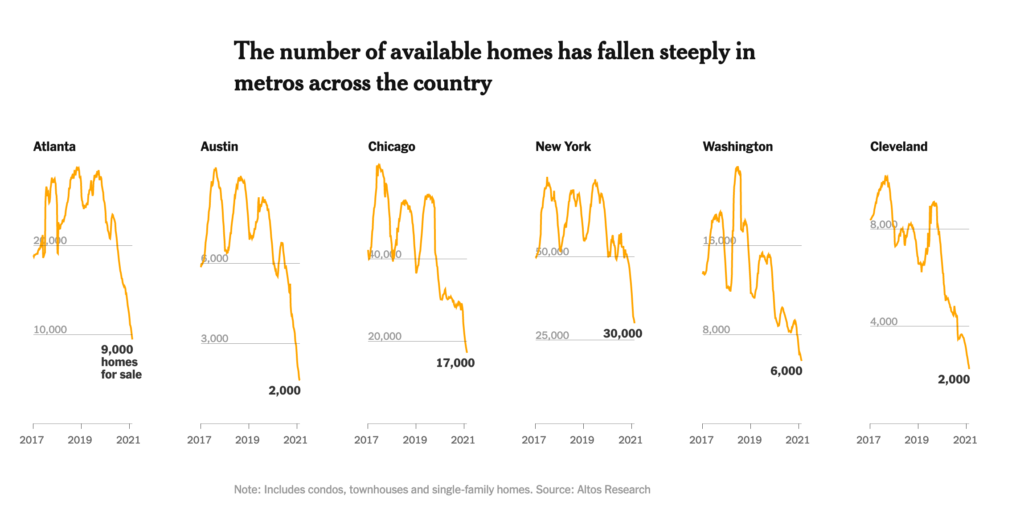

Even with more listings coming online, I’ve also experienced a robust buyer pool that’s still out there competing pretty aggressively for homes. Demand continues to remain very strong for well-priced homes that are turn-key and don’t need an immediate influx of cash for updates and/or repairs. Houses with dated or worn finishes, though, seem to be an area where buyers can find a decent deal, as long as they have some cash to make those changes, or have a time horizon where they’re willing to wait on making those improvements into the future. In a related sense, I think that buyers have become a bit choosier and aren’t willing to be pushed beyond their comfort zones of budget and necessity. Sellers had a few months there where anything goes, but I think we’re starting to see some of that power swing back towards buyers (ever-so-slightly at this point).

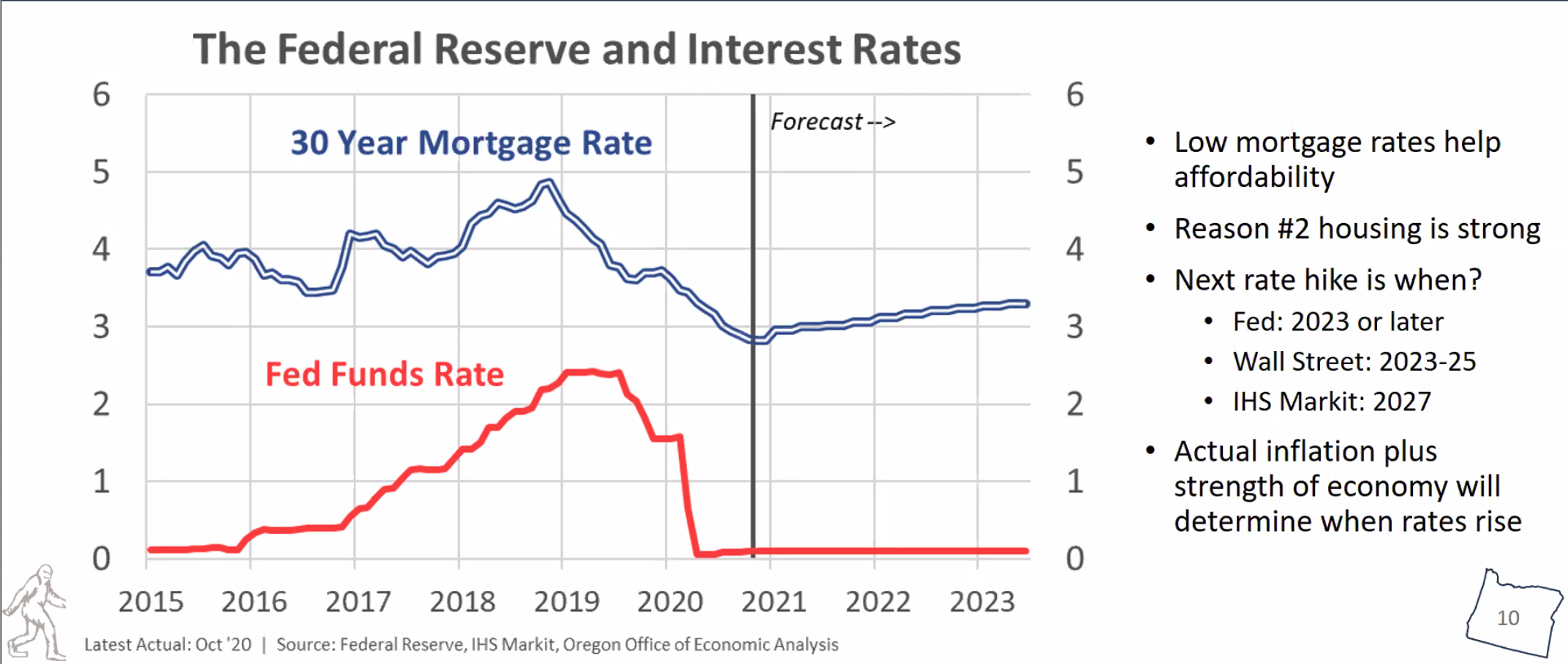

I also see pent-up buyer demand remaining high through the fall as interest rates continue to remain in record low territory, thus giving buyers continued borrowing/buying power. Interest rates are starting to bump up a little bit in response to the Fed’s plan to taper their purchases of mortgage back (MBS) securities and Treasury bonds (to support markets and keep the economy afloat as it tries to recover from the effects of COVID), but we’re still in a good window for buyers having access to favorable terms. The next Fed meeting on November 3rd will determine if the ’taper’ of these purchases will begin in earnest in 2022, or if job growth and weaker-than-expected economic activity will force the Fed to hold the line and push off the (inevitable) taper date further into 2022/2023.

A typical year in the housing market has cyclical swings, with slower activity in mid-summer and around the holidays/end-of-year. 2020 was, of course, anything but normal. Once we got through the late April/early May 2020 nosedive from COVID shutdowns and layoffs, it was game-on all year long and straight into 2021 without a break. However, this July and August felt markedly slower, which makes sense as things slowly are getting back to a more ‘normal’ place. I expect that we’ll see more of a seasonal dip around the holidays this year, as well. But that doesn’t mean that there won’t be new listings and buyer activity. It just may be a bit slower and less active than we’ve experienced for most of this year.

Remember that when we discuss ‘the market’, it’s for a huge swath of the Portland metro area, across all housing types, price points, and conditions. Understanding ‘your market’ is an important distinction, and one that your agent can help you identify, clarify and refine as you are looking to buy or sell your home most effectively.

And it’s good to note that the process for buyers and sellers, in this anxious global environment of unknowns, can be a major stressor. And that’s totally understandable, as it’s hard to feel in control of much these days. However, choosing an agent who will walk side-by-side with as a fierce, knowledgable and patient advocates is an important choice. Selling and buying homes is an in-depth, detail-oriented and time-consuming process. Be prepared and choose your team of agents, lenders and contractors wisely.

My business is 100% client-focused, and I want to make the process smooth, efficient and successful. I’m always available to learn how I can help you or someone you know make good things happen!